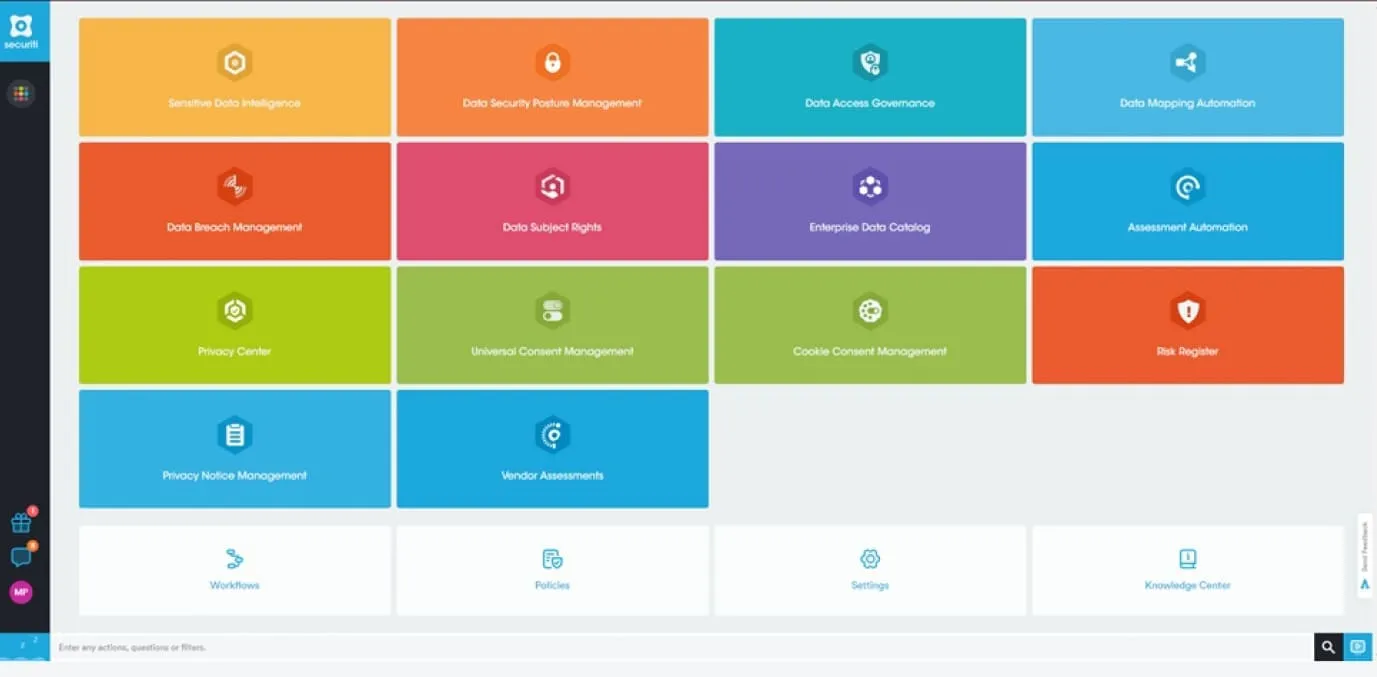

The bank’s unique requirements were adeptly addressed with Ahlan deploying Securiti.AI, an end-to-end data privacy platform. Ahlan designed a tailored approach after an in-depth understanding of the client’s operational environment and regulatory obligations. This dually aided in resolving the immediate challenges as well as building a scalable and resilient framework for long-term data privacy management.

Key solution components included:

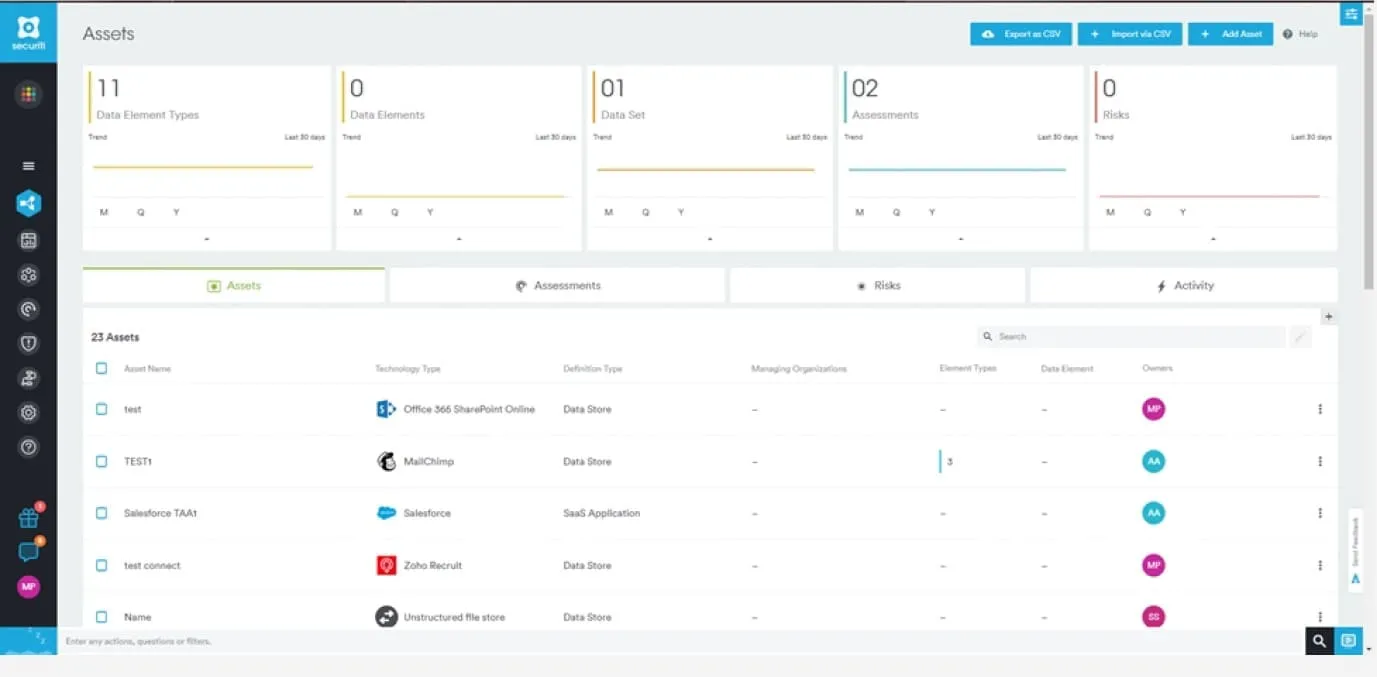

- Automated Data Identification & Classification: Leveraged advanced algorithms and machine learning to automatically identify and classify personal data across multiple sources.

- Governance Framework: Personal data management and regulatory compliance was proficiently handled with the established robust policies, procedures, and controls to strengthen governance.

- Data Mapping & Integration: Data mapping, covering data flows, repositories, and processing activities of the bank’s existing system was integrated seamlessly.

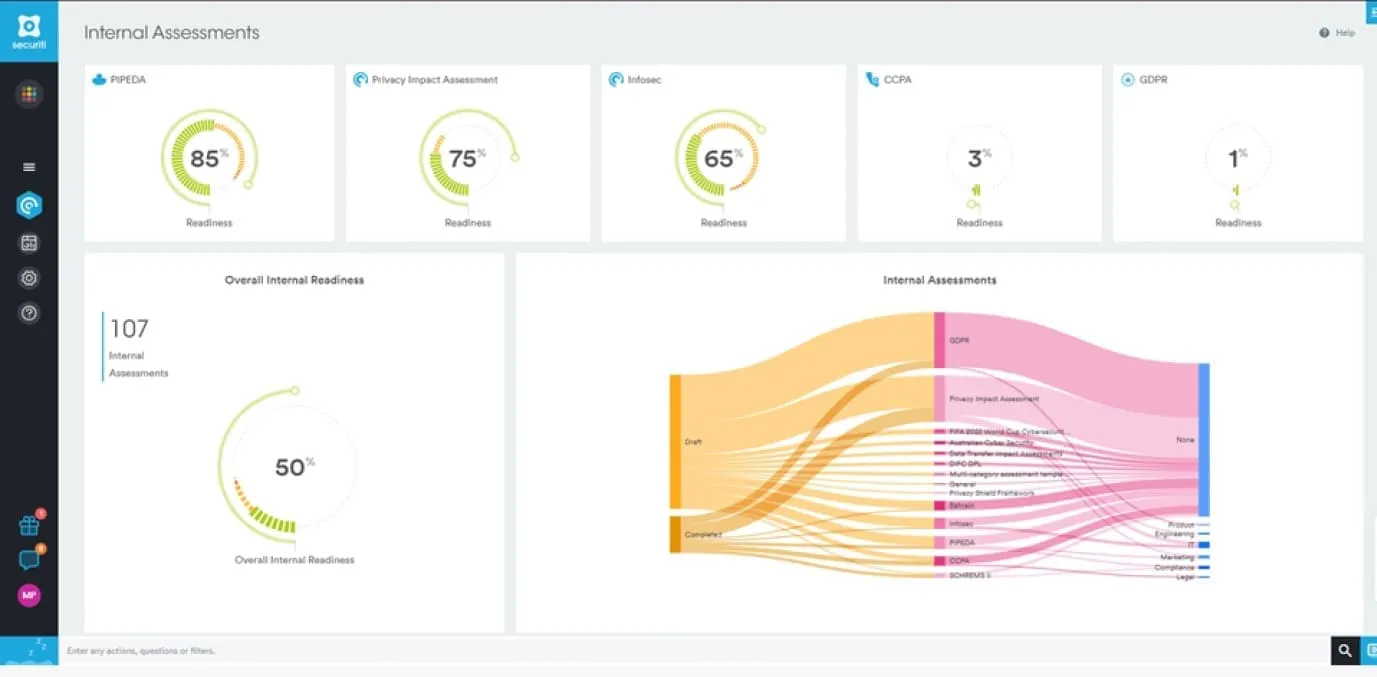

- Impact Assessments (DPIAs): Equipped the bank with tools to conduct Data Protection Impact Assessments, helping evaluate risks and implement safeguards for data processing activities.

- Extensive Data Discovery: Provided comprehensive visibility into operations with the analysis of over 500 processes to uncover data flows, dependencies, and usage patterns.

- ROPA Awareness Program: Conducted a Rights of Personal Data Owners (ROPA) awareness program to enhance employee understanding of data privacy responsibilities.

- Achieving Data Completeness: Incomplete processes and closed data gaps, ensuring a holistic and accurate view of the bank’s data landscape, were addressed.